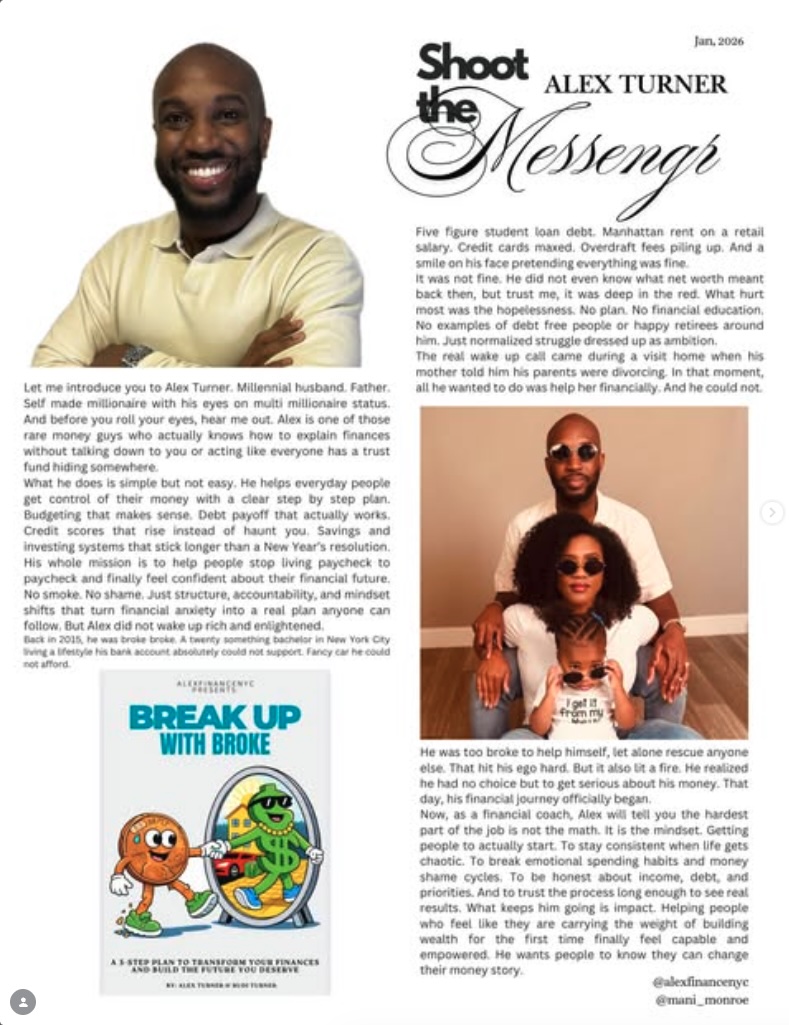

Let me introduce you to Alex Turner.

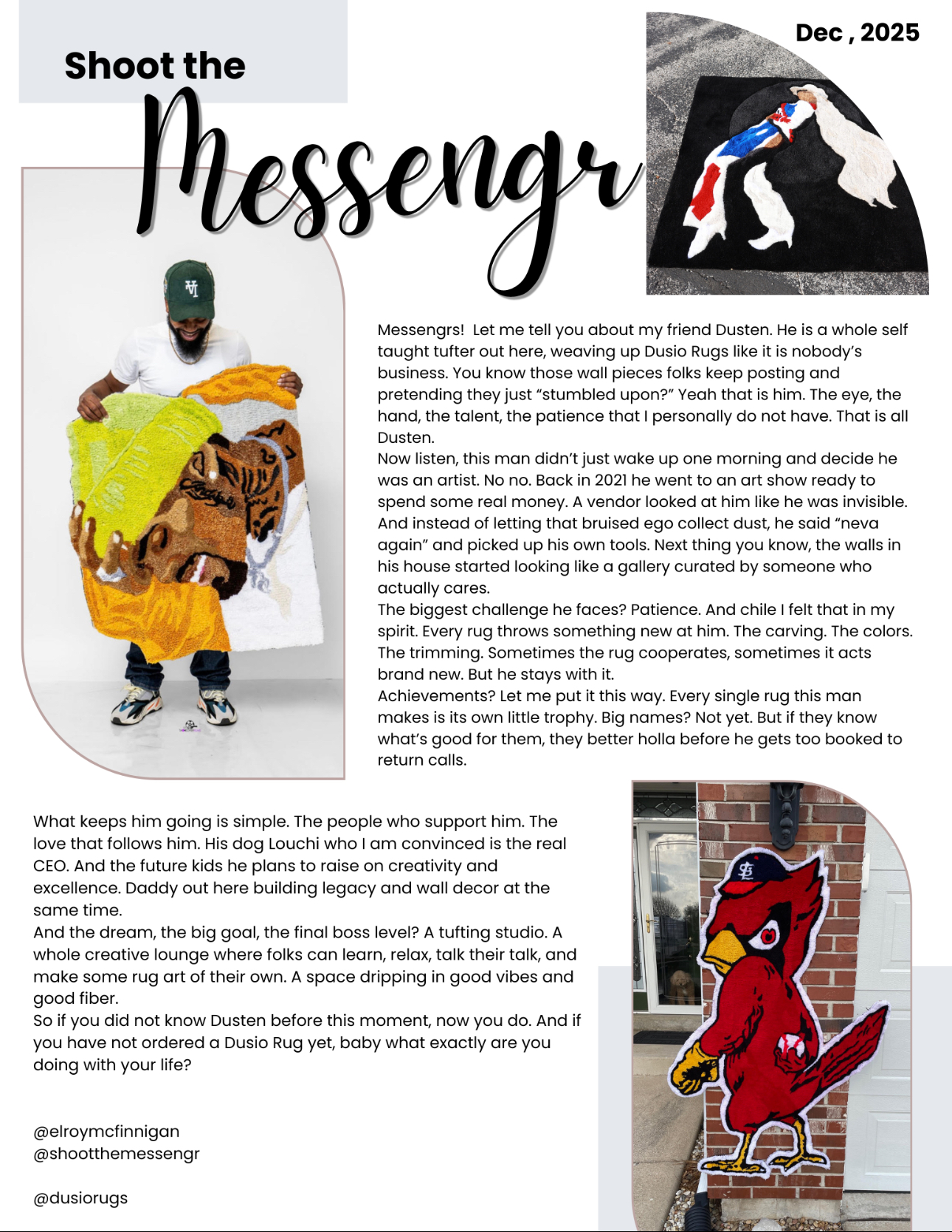

At first glance, Alex looks like someone who has it all together — a millennial husband, a father, self-made, confident, and financially secure. The kind of guy people assume was “always good with money.” But that assumption couldn’t be further from the truth.

Before you roll your eyes and think, “Here we go again,” understand this: Alex isn’t another finance bro talking over people or hiding behind trust-fund privilege. He’s one of the rare voices who actually knows how to explain finances in a way that feels human, relatable, and doable.

The Reality Behind the Smile

Years ago, Alex was drowning. Five-figure student loan debt. Manhattan rent on a retail salary. Credit cards completely maxed out. Bank overdrafts stacking up. And yet, he still wore a smile every day, pretending everything was fine — even when it wasn’t.

Back then, Alex didn’t even fully understand what went wrong. He just knew he was deep in the red. What hurt the most wasn’t just the debt — it was the hopelessness. No plan. No financial education. No examples of debt-free people or financially secure retirees around him. Just normalizing struggle and dressing it up as ambition.

The real wake-up call came during a visit home. His mother told him his parents were struggling financially. In that moment, all Alex wanted to do was help — and he couldn’t. He was too broke to even help himself.

The Decision That Changed Everything

That moment forced Alex to face reality. He realized he had no choice but to get serious about money. That day marked the official beginning of his financial journey.

Through discipline, education, and consistency, Alex learned how to take control of his finances step by step. He built budgeting systems that actually made sense. He paid down debt strategically instead of emotionally. He improved his credit score instead of avoiding it. He created savings and investment systems that worked long-term — not just as a New Year’s resolution.

His mission became clear: help people stop living paycheck to paycheck and finally feel confident about their financial future.

No Shame. No Gimmicks. Just Real Strategy.

What makes Alex different is his approach. There’s no shaming. No guilt. No smoke and mirrors. He focuses on structure, accountability, and mindset shifts that turn financial anxiety into real, actionable plans. His goal isn’t to make people rich overnight — it’s to make them enlightened, empowered, and consistent enough to see real results.

The hardest part of the journey, according to Alex, isn’t the math — it’s the mindset. Getting people to actually start. Staying consistent when life gets chaotic. Breaking emotional spending habits and money-shame cycles. Being honest about income, debt, and priorities. Trusting the process long enough to see it work.

Why He Keeps Going. What keeps Alex going is impact. Helping people feel lighter for the first time. Watching them stop carrying the weight of financial stress. Seeing someone realize they can build wealth, even if they’ve never seen it done before.

Alex wants people to know this: your money story isn’t finished. No matter where you start, you can change it. And sometimes, the messenger you least expect is the one who’s lived it, survived it, and came back to show you how.

@alexfinancenyc

@mani_monroe